Discover the benefits of investing in a money market fund, a low-risk investment option that offers stability and liquidity. Learn about the advantages of money market funds, such as low risk, high liquidity, stable returns, and diversification. Consider important factors before investing, including returns, expenses, and interest rates.

Individuals usually consider money market funds as a place to park their cash for the short term because they have low levels of volatility (for being an investment product) and the funds can be easily accessed (generally the next business day)

A money market fund can be a valuable addition to your investment portfolio, providing peace of mind and a reliable source of income. Consult with a financial advisor to make informed investment decisions based on your circumstances.

Introduction

When it comes to investing your hard-earned money, there are various options available in the market. One such option that has gained popularity over the years is a money market fund. In this blog post, we will explore what a money market fund is and why it can be a wise investment choice for individuals looking for stability and low risk.

Money Market Funds: Advantages and Disadvantages

Individuals usually consider money market funds as a place to park their cash for the short term because they have low levels of volatility (for being an investment product) and the funds can be easily accessed (generally the next business day)

Here’s Why You Should Invest In A Money Market Fund In 2024.

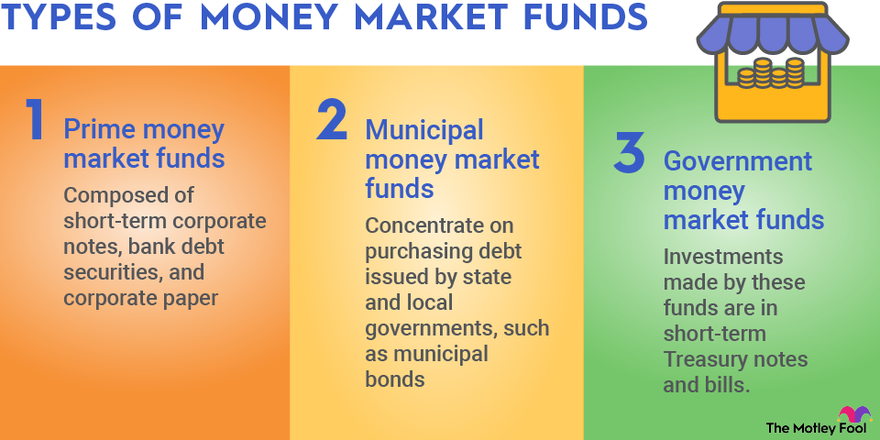

A money market fund is a type of mutual fund that invests in cash and low-risk, short-term debt securities.

Money Market Funds invest in Fixed Deposits, Government Bonds, T Bills, etc.

In Kenya, most MMFs are managed by Banks and insurance Firms and are regulated by the Capital Markets Authority.

Investors invest cash in the MMF, all the cash is pooled and invested heavily into financial instruments, the Fund takes commissions from the profits and distributes the rest to investors.

- Most MMF returns range from 8-11% p.a,. These rates fluctuate daily.

- The investor can withdraw their money in part or full, at any given time.

- For most Funds, you can quickly join via your mobile phone.

- Interest earned from MMFs is charged a 15% Withholding Tax.

Some MMFs in Kenya Include;

– Safaricom Mali [available on Mpesa app]

-CIC (40.5% market share)

-Sanlam (1.2% management fee)

-Zimele (sh 100 lowest deposit)

-Genghis

-Coop

-Britam

-ICEA

-Equity

-UAP Old Mutual

-Madison

-Nabo Africa etc

Advantages of MMFs

- Well regulated therefore low risk

- -Very liquid

- -Higher returns than Savings Accounts

- -No penalties for withdrawing principal

Disadvantages

- Relatively low returns

- -High tax and management fees

- Is it a good investment overall? YES!

Understanding Money Market Funds

A money market fund is a type of mutual fund that invests in short-term, low-risk securities such as Treasury bills, certificates of deposit, and commercial paper. These funds are managed by professional portfolio managers who aim to preserve capital and provide investors with a modest return.

Money market funds are known for their stability and liquidity. They are designed to offer a haven for investors, especially during times of market volatility. By investing in a money market fund, you can have peace of mind knowing that your money is relatively secure and easily accessible.

Benefits of Investing in a Money Market Fund

1. Low Risk: Money market funds are considered to be one of the safest investment options available. Since they invest in short-term securities with high credit quality, the risk of default is minimal. This makes them an attractive choice for conservative investors who prioritize capital preservation.

2. Liquidity: Unlike other investments like stocks or bonds, money market funds offer high liquidity. This means that you can easily access your funds whenever you need them without any penalties or waiting periods. This makes money market funds an ideal choice for emergency funds or short-term savings goals.

3. Stable Returns: While money market funds may not offer high returns like riskier investments, they do provide a stable and predictable return. The goal of these funds is to maintain a stable net asset value (NAV) of $1 per share. Though the returns may be modest, they are reliable and can provide a steady income stream.

4. Diversification: Money market funds offer diversification benefits by investing in a variety of short-term securities. This helps spread the risk and reduces the impact of any individual security’s performance on the overall fund. By investing in a money market fund, you can benefit from the expertise of professional portfolio managers who carefully select and manage the fund’s holdings.

Considerations Before Investing

While money market funds offer several advantages, it is important to consider a few factors before investing:

1. Returns: Money market funds typically offer lower returns compared to riskier investments. If you are looking for higher returns, you may need to explore other investment options.

2. Expenses: Money market funds charge expenses, which can impact your overall returns. Make sure to review the fund’s expense ratio and compare it with other similar funds before making a decision.

3. Interest Rates: Money market funds are influenced by interest rates. When interest rates are low, the returns on these funds may also be lower. Consider the current interest rate environment and how it may impact your investment before investing.

Conclusion

A money market fund can be an excellent addition to your investment portfolio, offering stability, liquidity, and low risk. Whether you are saving for a short-term goal or looking for a safe place to park your cash, a money market fund can provide you with peace of mind and a reliable source of income. However, it is important to carefully consider your investment objectives and review the fund’s prospectus before making any investment decisions.

Remember, investing always carries some degree of risk, and it is advisable to consult with a financial advisor who can provide personalized advice based on your circumstances.